Your income each year determines which federal tax bracket you fall into and which of the seven income tax rates applies.

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

Knowing your federal tax bracket is essential, as it determines your federal income tax rate for the year.

There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax legislation. For instance, the Tax Cuts and Jobs Act, also known as the “Trump tax cuts,” temporarily lowered the highest tax rate to 37% until 2025, after which it will increase to 39.6%.

So, which federal tax rate applies to your income depends on federal income tax brackets that do change because the beginning and ending income amounts for each tax bracket are adjusted yearly for inflation. What does that mean for you?

Be a smarter, better informed investor.

Save up to 74%

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Another important detail about federal tax brackets and associated income tax rates is that the rates are “marginal” tax rates. A marginal rate (discussed in greater detail below) is the tax rate you pay on an additional dollar of income.

For tax brackets and federal income tax rates, marginal tax rates mean that the rate associated with your tax bracket is the highest rate your taxable income will be subject to in a given tax year.

Also, some notes on inflation:

Tax bracket ranges also differ depending on your filing status. For example, for the 2024 tax year, the 22% tax bracket range for single filers is $47,150 to $100,525, while the same rate applies to head-of-household filers with taxable income from $63,100 to $100,500.

However, previously (for 2023) for single filers, the 22% tax bracket started at $44,726 and ended at $95,375. However, for head-of-household filers, last year's bracket was from $59,851 to $95,350.

So, with all of that in mind, here are the tax brackets for 2024 and 2023.

Further below, we consider some examples of how income tax brackets and marginal tax rates work.

Managing your finances in a tax-efficient way requires planning. Here are the inflation-adjusted tax brackets for the 2024 tax year (returns filed in April 2025).

Swipe to scroll horizontally| Tax Rate | Taxable Income (Single) | Taxable Income (Married Filing Jointly) |

|---|---|---|

| 10% | Not over $11,600 | Not over $23,200 |

| 12% | Over $11,600 but not over $47,150 | Over $23,200 but not over $94,300 |

| 22% | Over $47,150 but not over $100,525 | Over $94,300 but not over $201,050 |

| 24% | Over $100,525 but not over $191,950 | Over $201,050 but not over $383,900 |

| 32% | Over $191,950 but not over $243,725 | Over $383,900 but not over $487,450 |

| 35% | Over $243,725 but not over $609,350 | Over $487,450 but not over $731,200 |

| 37% | Over $609,350 | Over $731,200 |

| Tax Rate | Taxable Income (Married Filing Separately) | Taxable Income (Head of Household)) |

|---|---|---|

| 10% | Up to $11,600 | Not over $16,550 |

| 12% | Over $11,600 but not over $47,150 | Over $16,550 but not over $63,100 |

| 22% | Over $47,150 but not over $100,525 | Over $63,100 but not over $100,500 |

| 24% | Over $100,525 but not over $191,950 | Over $100,500 butnot over $191,950 |

| 32% | Over $191,950 but not over $243,725 | Over $191,950 but not over $243,700 |

| 35% | Over $243,725 but not over $365,600 | Over $243,700 but not over $609,350 |

| 37% | Over $365,600 | Over $609,350 |

Here are the 2023 federal tax brackets and income tax rates for the four most common filing statuses.

Swipe to scroll horizontally| Tax Rate | Taxable Income(Single) | Taxable Income(Married Filing Jointly) |

| 10% | Up to $11,000 | Up to $22,000 |

| 12% | $11,001 to $44,725 | $22,001 to $89,450 |

| 22% | $44,726 to $95,375 | $89,451 to $190,750 |

| 24% | $95,376 to $182,100 | $190,751 to $364,200 |

| 32% | $182,101 to $231,250 | $364,201 to $462,500 |

| 35% | $231,251 to $578,125 | $462,501 to $693,750 |

| 37% | Over $578,125 | Over $693,750 |

| Tax Rate | Taxable Income(Married Filing Separately) | Taxable Income(Head of Household) |

| 10% | Up to $11,000 | Up to $15,700 |

| 12% | $11,001 to $44,725 | $15,701 to $59,850 |

| 22% | $41,726 to $95,375 | $59,851 to $95,350 |

| 24% | $95,376 to $182,100 | $95,351 to $182,100 |

| 32% | $182,101 to $231,250 | $182,201 to $231,250 |

| 35% | $231,251 to $346,875 | $231,251 to $578,100 |

| 37% | Over $346,875 | Over $578,100 |

Now that you've seen the tax brackets, let's delve into some examples to show how the brackets and income tax rates work.

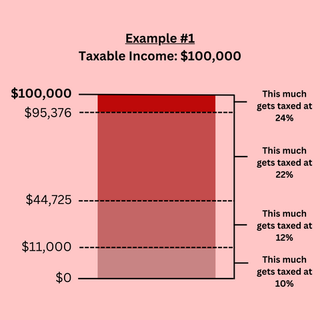

Suppose your filing status is single, and you had $100,000 taxable income in 2023. You may think that since $100,000 falls into the 24% federal bracket, your tax would be a flat $24,000. But thankfully, that’s not the case.

Instead, your $100,000 will be taxed at a marginal tax rate so that only some of your income is taxed at the maximum rate for your income that year (24%). The rest of your income is taxed at the federal income rates below 24%, i.e., 10%, 12%, and 22%.

Here’s how the marginal tax rate works with this example:

Given marginal tax rates, the estimated total federal tax on your $100,000 of taxable income would be about $17,400. That is $6,600 less than if a flat 24% federal tax rate applied to your entire $100,000 of income.

Remember: We're talking about federal tax. State tax rates and amounts due, if any, will vary.

The chart below shows estimates of how much of your income would be taxed at each rate.

Swipe to scroll horizontally| Income Portion | Federal Rate Applied | Approx. Amount of Tax |

|---|---|---|

| First $11,000 | 10% | $1,100 |

| $33,724 | 12% | $4,047 |

| $50,649 | 22% | $11,143 |

| $4,627 | 24% | $1,110 |

Total Estimated Tax: $17, 400

Here’s an illustration to help show how the marginal tax rate works with this example.

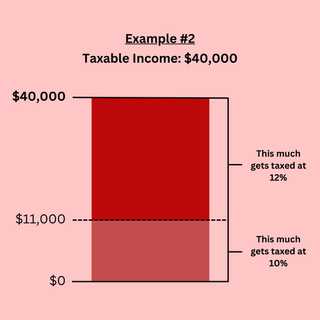

Take another example of someone single with a taxable income for the 2023 tax year of $40,000. You might think your tax would be $4,800 since $40,000 falls into the 12% federal bracket. But that’s not the case.

Instead, your $40,000 will get taxed at a marginal tax rate, so only some of your income is taxed at the maximum tax rate for your income that year (12%). The rest of your income gets taxed at the federal income rate below 12%, i.e.,10%.

Here’s how the marginal tax rate works with this example:

| Income Portion | Federal Tax Rate Applied | Approx. Amount of Tax |

|---|---|---|

| First $11,000 | 10% | $1,100 |

| $28,999 | 12% | $3,479 |

The total estimated federal tax of $4,580 is still a bit ($220) lower than the $4,800 you would be taxed if a flat 12% federal rate applied to your $40,000 of income.

The chart below shows estimates of how much of your income would be taxed at each rate.

Note: We're talking about federal tax. State tax rates and amounts due, if any, will vary.

Total Estimated Tax: $4,579

Here’s an illustration to help show how the marginal tax rate works with this example.

It's important to know that the marginal tax rate and your effective tax rate differ. As mentioned, the marginal tax rate is the percentage of tax applied to the next dollar of income. On the other hand, the effective tax rate is the overall percentage of income an individual pays in taxes after considering all deductions, exemptions, and credits.

To calculate your effective tax rate, divide the total taxes paid by the total taxable income. For example, if an individual earned $50,000 and paid $7,000 in taxes, their effective tax rate would be 14% ($7,000 / $50,000 = 0.14 or 14%).

If you have any questions about your tax liability, it's always a good idea to seek advice from a qualified tax professional or financial advisor.

There's been a lot of interest in what might happen with tax brackets and federal income tax rates in the coming year. Some of this is due to the upcoming 2024 presidential election. For example, as Kiplinger reported, Project 2025, which addresses several policy issues including taxes, is seen as a blueprint for a potential Republican administration.

However, as you may know, 2025 was already expected to bring legislative debate over changes in tax policy. This is due to the scheduled expiration of several key tax provisions in the Tax Cuts and Jobs Act of 2017 (TCJA) at the end of next year.

While it is unclear how the election or the TCJA "tax cliff" will specifically impact tax brackets, stay tuned. The IRS is expected to release the 2025 inflation-adjusted brackets in a few months.